July 2023

Insurance Alone is Not Enough

The Problem

The U.S. healthcare financing system is essential to care delivery, yet fractured. Increasingly, stories of patients struggling with medical debt are splashed across the news or shared directly by family and neighbors. Surprisingly, people with health insurance often carry medical debt. More than half of adults nationwide carry or have carried some medical debt in the last five years (54%) despite over 90% of people having health insurance last year.

Insurance is clearly not enough, and medical debt impacts all patients regardless of coverage. Further, medical debt disproportionately affects households of color. This devastating trend can lead to prolonged exposure to financial insecurity undermining people’s health, dignity, and livelihood. Researchers describe this as ‘medical financial hardship’ composed of three domains: medical debt, distress, and coping behaviors. While over half of uninsured people experience one or more domains of medical financial hardship, one in four insured people share in this experience—noting that health insurance with high-cost sharing is insufficient to protect them from medical debt. Our survey findings show that close to 90% of respondents have some form of healthcare coverage whether through their employer, a plan they purchased themselves (such as through an Affordable Care Act (ACA) Marketplace), or Medicaid or Medicare.

- While almost all of respondents reported being insured, 68% carry medical debt.

- Of people with insurance, 26% are ‘at-risk’ of medical debt meaning that they used an unsustainable payment method for their last medical bill such as using a credit card, taking out a loan or borrowing from friends or family.

- Of people with insurance, respondents with employer-based coverage or Medicare reported the highest rates of medical debt (71% and 74%).

In this issue brief, we share findings from our recent survey showing that insurance alone is not sufficient to protect patients from medical debt and we outline the ways providers like hospitals and health systems can increase community health and combat the physical, mental and financial toll of medical debt.

Our Findings

More than half of survey respondents report affordability as a barrier to accessing healthcare. Just over half (51%) of respondents say they have trouble affording the costs of healthcare that insurance does not pay for, including 23% who struggle to pay their monthly premium.

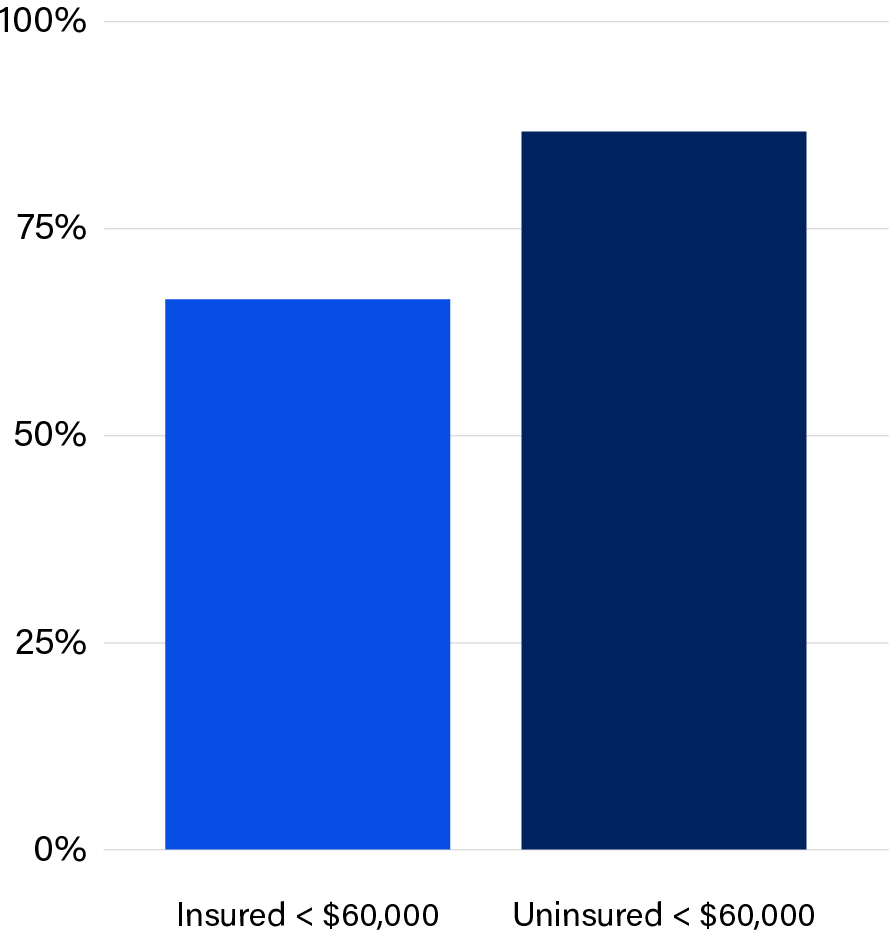

Among the insured group earning less than $60,000, 67% of survey respondents have medical debt compared to 88% of the uninsured group earning <$60,000. For people living at or below 400% of the federal poverty level (FPL) or about $60,000 for an individual household, insurance does not protect them from harm (Figure 1). The top three reasons respondents list as to why they ended up with medical debt include: surgery/medical procedure (27%), emergency care (25%), and hospitalization (16%). All of these reflect events that are non-elective, necessary, and often unexpected, yet too costly for patients, especially when faced with high deductibles, co-pays, and coinsurance. Our findings are validated by research from the Commonwealth Fund highlighting that 60% of people with insurance, but with unaffordable out-of-pocket expenses, faced problems with medical bills and medical debt.

FIGURE 1

Do you currently have medical debt?

“Having medical debt comes with a lot of mental stress for me. It prevents me from saving money for myself and my family and for emergency situations. Even with health insurance, I don’t understand the high amount I have to pay out of pocket. It’s very frustrating and stressful to focus on my health.”

Sara

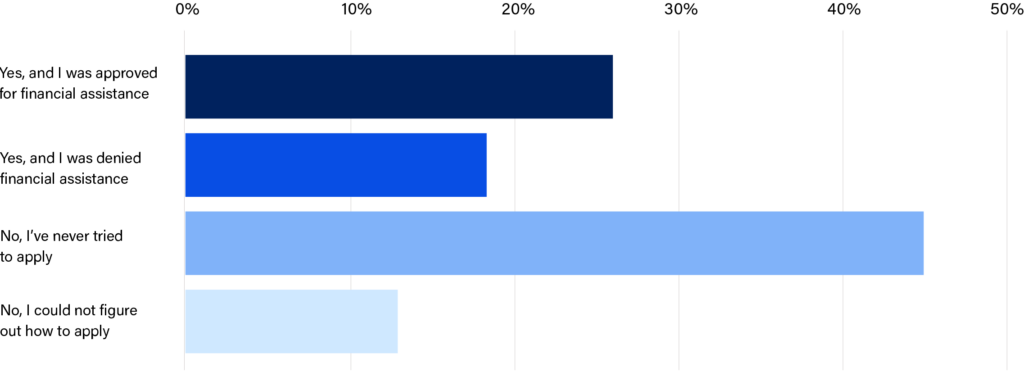

For respondents, financial assistance is inconspicuous and largely underutilized. 57% of respondents were not aware of financial assistance programs, over 44% of respondents never tried to apply for financial assistance, and 12% could not figure out how to apply (Figure 2).

FIGURE 2

Have you ever applied for financial assistance?

Financial assistance policies can serve as a protective factor against medical debt and financial hardship. Most hospitals have financial assistance policies designed based on the communities they serve. Increasingly, states are creating guardrails and eligibility floors to ensure broader access to financial support for medical bills. It is required by nonprofit hospitals and, on average, they provide no-cost care to people earning below 200% FPL, though many policies exceed this level. Physicians working at the hospital may or may not participate in the hospital’s policy, adding a layer of ambiguity that muddies an important pathway.

“I was very fortunate that my last Emergency Department visit qualified for charity. I only owe $39 for x-rays and the EKG. However, I’ve postponed follow up care due to costs for prescription copays and the clinic visit. I’m also hoping in the near future to find affordable health coverage so I can receive better quality care.”

Dennis

Through accessing financial assistance, some patients can mitigate the financial harm of medical debt. Despite this, we can conclude that healthcare remains unaffordable and medical debt unavoidable, as expressed in firsthand testimony.

Over half of respondents deferred medical care as a result of their medical debt (55%). This is a dangerous coping behavior that compromises people’s financial stability and health status. Almost half of respondents that carry medical debt report attempting to self-treat (48%), skipping a doctor when they needed to (40%), skipping routine care such as check-ups, screenings and vaccines (38%), or skipping or reducing prescription medications (21%).

Over 57% of respondents avoid answering and returning calls from healthcare providers.

It is clear from both the survey data presented and from national data sources that out-of-pocket obligations are crushing patients, especially lower-income households that are financially vulnerable to unexpected bills. Research from Crowe Revenue Cycle Analytics highlights that 58% of bad debt (write-offs related to uncollectable balances) accounts for amounts unpaid by insured people. The rise in high deductible health plans (HDHPs) continues to place working people at risk of medical debt and worse health outcomes as patients delay or opt out of healthcare services due to cost.

“The overall cost of treatment is overwhelming. I avoid the doctor because I cannot afford the cost but at times it’s detrimental. Then I end up in the hospital, sometimes for days at a time. I just can’t afford the cost of healthcare.”

Karla

Why this Matters for Hospitals

Hospitals are the focal point of healthcare access and delivery in their communities, working to continuously engage with patients to improve their health. When patients forgo care or reduce their use of healthcare services, they risk undermining their health and financial security. Further, patients elevate their risk for experiencing a major illness or catastrophic episode of care which will ultimately result in higher uncompensated care costs down the road for hospitals. More than ever, insured people are struggling with medical debt and putting their health at risk, making it a priority for hospitals to help all patients avoid overwhelming debt regardless of insurance.

What Can I Do?

As the insurance landscape continues to shift toward higher rates of HDHP enrollment, people are struggling with their out-of-pocket costs that are unaffordable. While hospitals cannot directly address the severe shortcomings of the health insurance system, they can reassess what financial assistance looks like in the current landscape. Our survey data, reinforced by national findings, highlights a need to re-evaluate financial assistance policies for the insured and identify more efficient pathways for financial assistance program enrollment. We recommend hospitals revise their financial assistance policies to include insured people in their eligibility criteria and identify ways to streamline enrollment. Both these actions could reduce the administrative burden for patients and build continuity and trust with providers.

Stay tuned for our next phases of research, which will dig deeper into recommendations for solutions and implementation.

Hospitals May Consider

- Reviewing their financial assistance policy to include insured people in eligibility criteria, especially for people earning below 400% FPL.

- Increasing accessibility of their financial assistance program, including examining talking points used in the billing process.

- Investing in software tools (presumptive eligibility for financial assistance) that can automate eligibility verification. Thus, patients can enroll in financial assistance without having to complete an application. This should apply to both insured and uninsured populations.

- Revising financial assistance policies to provide 12-month continuity; an important tool in keeping people healthy.

- Collaborating with sector stakeholders to leverage data on insured people with unpaid bills to reduce the use of high deductible health plans (HDHPs) that are harmful and unaffordable for low- to moderate-income workers.

Project Background

Neighborhood Trust and Undue Medical Debt are partnering to generate awareness, understanding, and solutions that enable employers and hospitals to do their part to reduce medical debt burdens, specifically among lower-wage workers. This work will bring the perspectives of low-income workers and those below the poverty line to the forefront of discussions about medical debt and health benefit designs. For Phase 1 1 of this project, we surveyed2 230 low-income individuals, including Neighborhood Trust’s financial coaching clients and those that have benefited from Undue MD’s medical debt relief work. The survey included questions about respondents’ medical debt burdens, the impacts of their debt, and how they accrued it.

Survey Respondent Demographics

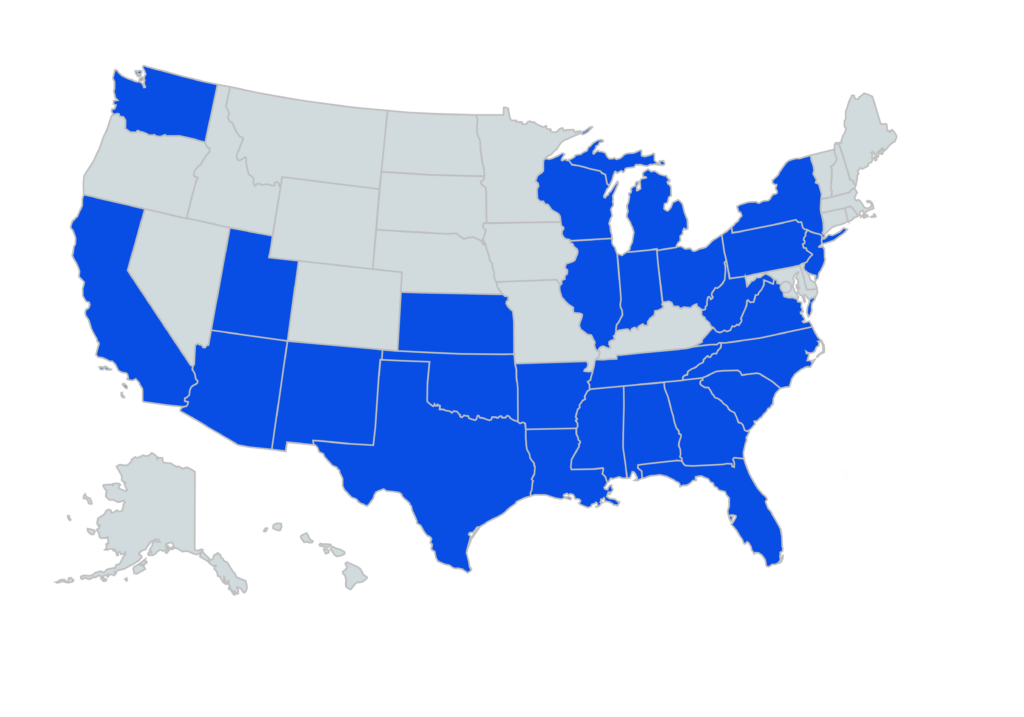

Participants represented 27 states, with most respondents in TX, MI, SC and FL.

- 76% of respondents reported household income of $60,000 or below.

- 80% identified as female.

- 32% identified as Black or African American, 36% as Caucasian or White, and 17% Hispanic or Latino.

- Average health rating on a scale of 1-5 was a 2.83, with 1 being poor and 5 being excellent.

- 68% reported currently having medical debt.

- 75% estimated having between $500 and $10,000 in medical debt.

- Phase 1 (“Awareness) of this project intends to increase awareness of the prevalence and negative impacts of medical debt, and why it should matter to employers and hospitals to intervene. Phase 2 (“Understanding”) will aim to surface nuanced underlying drivers of medical debt that may be overlooked or misunderstood, and that present innovative leverage points to reduce medical debt, via individual qualitative interviews. And Phase 3 (“Solutions”) will offer recommended solutions for employers and hospitals to take up, incorporating new leverage points revealed in Phase 2 and accounting for implementation barriers. ↩︎

- 2 We designed our survey in QuestionPro, with support from the Social Policy Institute at WashU. Several of the questions we included were previously validated by the Kaiser Family Foundation’s research. We emailed the survey to 3,220 Neighborhood Trust clients, and 897 Undue Medical Debt beneficiaries, and pledged $5 gift cards for their time. We received 230 complete responses after 3 rounds of outreach. We then conducted X/Y comparison analysis in Excel. ↩︎